Could Trump’s Tariffs Accelerate the Dollar’s Decline?

Could Trump’s Tariffs Accelerate the Dollar’s Decline?

By Mehmet Enes Beşer

Donald Trump’s revival of aggressive tariff policy has once more shook global markets. His threat to block blanket duties on Chinese imports—and an upcoming 10% blanket tariff on all imports—represent not simply a reversion to protectionism, but a more profound disintegration of the multilateral trading regime the U.S. itself built. But below the headlines about shattered supply chains and jittery investors is a deeper, wider question: could these perpetual jolts to global trade confidence someday erode the U.S. dollar’s role as the world’s anchor currency?

The U.S. dollar has, for decades, dominated the world financial system with unparalleled dominance. It is the world’s reserve currency, the medium of most international trade transactions, and the benchmark against which commodities ranging from oil to wheat are priced. The dollar status confers gigantic geopolitical advantages on Washington, allowing it to finance chronic deficits, levy financial sanctions, and project influence far beyond its borders. But this dominance also rests on one critical assumption: that America is a stable, rule-abiding custodian of the world economy. Trump’s tariff-first policy renders that assumption irrelevant.

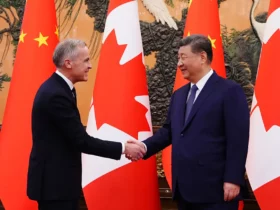

Beijing’s reaction to the new wave of tariffs indicates a deeper strategic shift. While it hasn’t abandoned talk, China is blunter in rejecting what it considers “economic coercion” and in presenting itself as a champion of free trade. But even more, China is actively pursuing de-dollarization—not on ideological grounds only, but because it needs to survive. With the yuan already used in over 30% of China’s cross-border trade and a growing share of energy imports priced in renminbi, the foundations of a new financial order are already in motion. The Belt and Road Initiative (BRI), the China–Russia energy trade, and the Cross-Border Interbank Payment System (CIPS) all reflect Beijing’s determination to insulate itself from dollar-denominated leverage.

While the yuan is not poised to supplant the dollar in direct substitution—it lacks full convertibility, deep capital markets, and global trust—the direction of travel is clear. Trump’s erratic trade policies, especially if they are followed by financial sanctions or restrictions on capital flows, reinforce fear among emerging economies that the dollar is no longer a neutral currency. For many, the message is sobering dependence on U.S. monetary infrastructure carries strategic risk. From the eurozone to Southeast Asia, the push towards currency diversification, regional swap lines, and electronic payment choices is picking up steam.

Dethroning of standing to the dollar cannot happen in spectacular collapse but by way of piecemeal, structural disconnection. Reserve managers can incrementally decrease exposure to dollars. Commodity-exporting nations can experiment with different invoicing structures. Central banks can boost bilateral currency settlements out of the dollar grid. These individually de-crown not the greenback but taken together paint the outline of a post-dollar world.

Ironically, what supports the dollar is less U.S. economic success, and more international confidence in Washington’s commitment to be open, transparent, and beholden to the rule of law. Trump’s tariff regime—and the implicit message it conveys, that U.S. policy is now susceptible to nationalist whimsy—undermines that foundation. Global capital is sticky, not stagnant. The more Washington employs its economic power as a bludgeon, the more the world looks for exit ramps.

This shift also has implications for the legitimacy of Western-led institutions. The World Trade Organization hangs in the balance, the credibility of the IMF is waning among the Global South, and the G7 seems increasingly disconnected from a multipolar world. China’s promotion of multilateralism is not solely self-serving, but it resonates with countries that are made to feel outside U.S.-centric rules. Here, Beijing’s “guarding the free-trade system” rhetoric is not merely more than an exercise in deflection; it is strategic positioning to lead the coming new global economic order.

The real danger to Washington is not China’s overnight domination but self-inflicted damage by the U.S. that makes the world change faster. Trump’s tariffs can be popular at home but blow away the conditions that enable the U.S. to hold the world’s monetary leadership. Making the dollar a tool of unpredictability instead of stability will weaken its appeal as a reserve and transaction currency.

Conclusion

The global monetary order is not static. It is an expression of trust, policy coherence, and institutional stewardship. Donald Trump’s tariff war risks derailing all three. Even as the dollar is stuck in the present, the path to multipolar finance is no longer abstract—it is incremental, patchy, and increasingly real.

Beijing, sensing this shift on the horizon, is not just reacting—it is preparing. Its efforts to internationalize the yuan, build financial infrastructure, and promote South–South economic alliances all have one thing in common: reducing exposure to dollar-based shocks. China can’t yet supplant the U.S.—but it doesn’t need to. It merely needs to offer enough of an alternative to spark change.

Trump’s tariffs may or may not trigger an all-out trade war. But they have already begun to create a subtler, more enduring impact: a reevaluation of the role of the U.S. dollar in the world. If Washington continues to view global leadership as transactional, it may soon discover that the world has transacted quietly elsewhere.

Leave a Reply