Washington finalized a $20 billion currency swap framework with Argentina and bought pesos, making good on President Donald Trump’s pledge. Here’s what he gets in exchange.

Washington finalized a $20 billion currency swap framework with Argentina and bought pesos, making good on President Donald Trump’s pledge. Here’s what he gets in exchange.

By Rodolfo Treber, Buenos Aires, Argentina*

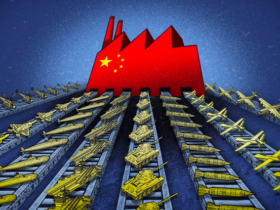

The economic policy of Javier Milei ‘s government consolidates a historical pattern in Argentina’s relationship with international financial capital: the use of foreign debt not as an instrument of development, but as a mechanism of political domination and sovereign subordination. The recent swap agreement with the United States Federal Reserve represents a new chapter in the deepening of this process, clothed in modernity and technicality, but fundamentally structurally similar to the old prescriptions of the International Monetary Fund.

Presented as a “liquidity provision” instrument between central banks rather than as traditional debt, the swap actually involves the placement of short-term external liabilities in exchange for fresh dollars. Its real objective is not to boost production or employment, but to sustain the flow of speculative capital that fuels the financial cycle. It guarantees foreign currency to those who finance the Treasury at exorbitant rates and, in doing so, provides political stability to the government without resolving any of the structural problems of the Argentine economy. The market reaction was immediate: country risk fell and a fleeting calm was felt among traders, confirming that the main beneficiary is not the Argentine people, but global financial capital.

However, behind this technical facade lies a deeper encroachment on sovereignty. The bailout is neither neutral nor free: it imposes political and strategic conditions. The United States will demand concrete compensation, from limiting financial ties with China to making the exchange rate regime more flexible to facilitate the free outflow of capital. This conditionality goes beyond economics: it is a surrender of sovereignty in the definition of public policies, a delegation of power in favor of foreign interests that determine the country’s course from outside.

Operationally, the swap is simple and is defined as short-term debt:

- The Central Bank of the Republic of Argentina receives a certain amount of dollars from the Federal Reserve.

- In exchange, they deliver an equivalent amount in pesos or other instruments, becoming obligated to repurchase the dollars in the future.

- The dollars obtained are not used for productive investment, but rather to ensure payment to financial capital or to intervene in the foreign exchange market.

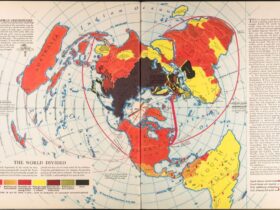

The operation also has a clear geopolitical component. In an international scenario characterized by the rise of multipolarity, Washington seeks to reaffirm its regional hegemony and curb the advance of China, which in recent years has become a major financial player for Argentina through swaps, investments, and infrastructure financing. The agreement with the Federal Reserve not only pursues immediate financial objectives but also repositions the United States as the arbiter of national economic policy and the custodian of its strategic interests in the Southern Cone.

The deepening of debt under the Milei – Caputo administration confirms this trend. Debt once again reveals itself as a tool of plunder: obligations are socialized while profits are privatized. As in previous cycles, each new financial operation opens the door to internal adjustment, popular impoverishment, and the transfer of resources abroad.

The statements and gestures toward Washington reveal a willingness to hand over strategic state resources in exchange for financial and political support, deepening an asymmetric relationship that nullifies any hint of sovereignty and economic independence.

Recent history shows that debt has not been a tool of progress but of domination. Every agreement with the IMF or international financial actors has been accompanied by conditions, adjustments, and the dismantling of productive capacities. The swap with the United States is no exception to this logic: under the guise of a technical instrument, it consolidates a model of financial, political, and geopolitical subordination. While promises of stability and modernization are repeated, the country remains tied to the dictates of foreign interests, unable to determine its own destiny.

Breaking this vicious cycle requires regaining sovereign control over monetary and financial policy, rebuilding an economic system oriented toward national development, and rejecting external impositions that mortgage the future. Without economic independence, there is no national project possible, and as long as debt remains the cornerstone of economic policy, Argentina will continue to be managed by its creditors.

* Rodolfo Pablo Treber is an economy analyst who works for the Central Bank of Argentina.

Leave a Reply