Details on how President Milei’s financial policy is failing.

Details on how President Milei’s financial policy is failing.

By Horacio Rovelli*.

In football, “extra time” refers to the minutes of extra time granted when the “regular time” ends.

This is what is happening with the current financial program of the team chaired by the Milei brothers, with as main players the Minister of Economy, Luis Caputo, and the president of the Central Bank, Santiago Bausili.

In fact, it is worse, because while the Caputo-Bausili duo was looking for the Anker point, named after the consulting firm they both have in Manhattan and which is understood as the point where the devaluation rate of the official exchange rate (the price of the dollar), the interest rate and prices converge, the auction of Treasury bonds on February 26 indicates that, instead of converging, the gap is widening, and the general framework of disbelief about the price of the dollar is joined by the LIBRA cryptocurrency scam, for which the Milei brothers are going to have to answer to the justice of the United States, Spain and other countries.

Indeed, the Ministry of Finance has scheduled debt maturities in pesos every other Wednesday. On February 12, it held the auction of debt securities that matured that day, for 6.6 billion pesos and, as happened in the calls in January, the objective of rolling over all the maturities was not achieved, despite the fact that the Treasury of the Nation pays higher interest rates and offers shorter terms. Most of it was in LECAP (Capitalizable Letters that pay interest and amortize capital at the end) with maturity on March 14, 2025 (30-day term) and at an effective monthly rate of 2.53%, when since February 1 the official dollar price adjustment is 1% monthly.

On Wednesday, the 26th, 2.7 trillion pesos worth of bonds matured, but this time it obtained a higher figure of 4.4 trillion, by paying an interest rate of 2.58% per month in LECAPs maturing on March 31, for 1.357 trillion pesos; a rate of 2.56% per month for 780 trillion pesos in LECAPs maturing on April 28; and a rate of 2.53% per month for another LECAP for 1.328 trillion pesos maturing on June 18. The remaining 959 trillion pesos were in BONCER (inflation-adjusted bond) plus a 5.34% bonus, maturing in May 2025.

Meanwhile, carry trade continues, but at an ever-increasing rate and for every time shorter terms. Obviously, higher rates imply higher financing costs and a reduction in the level of activity, which are exhausting the mechanism for continuing to support the exchange rate.

The government increased the public debt by 97.114 billion dollars in 13 months. It is a record figure: no government, not even Mauricio Macri’s in 2018 with the exorbitant debt with the IMF, increased the debt by that amount and in that period, for the benefit of bondholders (mainly large financial funds from abroad), while companies are closing, unemployment is increasing, salaries, pensions and retirements are falling, and poverty is increasing. And neither the Argentine Congress nor the Argentine Justice are asking how this debt was generated.

Because they also did not ask how the debt increased by 147.971 billion dollars during the governments of Mauricio Macri and Alberto Fernández. With that level of indebtedness, the Paraná River and the ports on the river were not recovered, a state merchant marine was not created, a million homes were not built, etc. The national public debt was 222.703 billion dollars when the government of Cristina Fernández de Kirchner ended (60% of it was intra-public sector, held by the ANSeS Sustainability Guarantee Fund [1], official banks, various Argentine trust funds, etc.) and rose to 370.674 billion dollars in December 2023 (mainly the creditors are the IMF and financial capital based in Manhattan).

The government that generates such debt has spent no less than 22 billion dollars by February 2025 to support the peso at the current parity. Last year it spent almost 16 billion dollars on the so-called “dollar blend” (which allows 20% of exports to be settled on the free market without paying any duty and at the CCL market price, and exports worth 79.721 billion dollars were declared), a system that continues and which the IMF demands the government end.

At the same time, the direct intervention of the Central Bank by selling dollars from international reserves is increasing, as is that of the BCRA, the Treasury and, since February, the FGS (ANSeS Sustainability Guarantee Fund) by selling dollar-denominated securities, following the appointment of Fernando Bearzi (trustee of Noctua, the offshore company in the Cayman Islands chaired by Luis Caputo) as head of ANSeS.

In 2024, a trade surplus of 18.889 billion dollars was achieved, but the net reserves of the Central Bank are negative by no less than 6 billion dollars.

Desperate to increase exports, the government allows the sale of live cows abroad (live cattle), and to bring dollars into the Central Bank, banks were authorized to make loans in dollars to any client (dollars are exchanged for pesos at the official exchange rate by the BCRA), both companies and individuals, when since the crisis of 2001 they could only lend to exporting firms or those whose income was tied to the fluctuations of the dollar.

However, this does limit them whenever banks use their own dollars (obtained through borrowing from abroad, via negotiable bonds or loans) to lend to any type of public, even those whose income is entirely in pesos.

In parallel and contradictorily, it reduces tariffs that, with the current parity, favor imports. Therefore, the greater commercial openness and the foreign currency destined to contain the gap between the official dollar and the financial ones generate that the current account of the Balance of Payments (which includes financial and real services [2] ) is increasingly negative.

Without genuine income and with a fiscal surplus achieved by placing LECAP and NOCAP that capitalize and pay interest upon maturity (capitalizable interest exceeded the primary fiscal surplus of 2024 and also that of January 2025), they do not have the money to pay debt bonds in pesos, which this year exceed 90 billion, nor to pay debt securities in foreign currency (this year securities for 21,147 million dollars mature), which could only be paid if these maturities were largely renewed.

The background of the problem

The government is discussing with the IMF an extension of credit (in 2018, it had been granted the equivalent of 57 billion dollars in SDRs and received 44,559.9 million, in the face of clear non-compliance by the Macri government).

Subordination to the IMF is exercised in a framework in which the dominant leadership of our economy, which is basically divided into three very different sectors, is nevertheless united by three causes:

- There should be no investigation into where the 147.971 billion dollars in which the governments of Cambiemos (PRO-UCR) and Alberto Fernández indebted the country went. They also benefited from their supposed or real debts with foreign countries that they paid during the administration of the Fernández and Massa with the purchase at the official price of international reserves of the BCRA for 28.350 billion dollars. And they continue to benefit from the purchase of bonds adjustable by inflation, given the monthly fixing of the official exchange rate ( carry trade ).

- The progress on the rights of the population reflected in DNU 70/23 and laws 27,742 of “Bases and Starting Points for the Freedom of Argentines” (includes the Regime of Incentives for Large Investments –RIGI– and changes labor legislation) and 27,743 of “Palliative and relevant fiscal measures” (includes money laundering), which harm workers, retirees and pensioners, tenants, consumers, the national heritage and our sovereignty, but benefit big capital, both local and – above all – foreign.

- With the alienation of the national heritage on land, its subsoil, water, natural resources (oil and gas, lithium and other minerals of all kinds, food, etc.) and public companies, as is the case of the decrees of conversion into public limited companies of the Banco de la Nación Argentina and Yacimientos Carboníferos Río Turbio (YCRT).

The three benefited sectors can be grouped into:

- Foreign capital, led by large financial funds (BlackRock, Vanguard, PIMCO, Franklin Templeton, Fidelity, Greylock and others) whose backing is the Argentine- North American Chamber of Commerce (AmCham) and to which the economic team headed by Caputo and Bausili pays taxes.

- The Argentine Business Association (AEA) is chaired by a man linked to the United States embassy and, as such, the main convener of the commemoration of the 4th of July, Jaime Campos. The main directors and vice-presidents of AEA are Paolo Rocca (Techint), Héctor Magnetto (Clarín) and Luis Pagani (Arcor), and the members are Cristiano Ratazzi (FIAT), Alfredo Coto (Coto supermarket), Sebastián Bagó (Laboratorios Bagó), Luis Pérez Companc (Molinos Agro), Eduardo Elsztain (IRSA), Alejandro Bulgheroni (PAE), etc.

- The Argentine Agrarian Council (CAA), which was formed in July 2020 with more than 40 chambers and entities such as CONINAGRO (Confederación Inter Cooperativo Agropecuaria), Confederaciones Rurales Argentinas (CRA) and Federación Agraria Argentina (FAA), and has diverse associates and sectors, covers practically all members of the agricultural, grain, and poultry, beef, and pork value chains; the industries and chambers linked to the production of soybeans, corn, wheat, rice, peanuts, cotton, wood, and fishing, among others; and the exporting companies grouped in the Cereal Exporters Center (CEC), where Aceitera General Deheza, COFCO, Cargill, Viterra, Louis Dreyfus, Molinos Agro, etc. participate. In addition, there are the Cereal Exchanges and collectors from all over the country, uniting producers, collectors, marketers, industrialists, biofuels, and exporters.

The three sectors (which are interrelated) benefited and benefit from the flight of capital and the transfer of that debt to the Argentine people [3], exacerbated exponentially by the carry trade.

It is the external debt and the foreignization and economic concentration in our country that impose an extractive, agricultural-exporting matrix, which is why industries that substitute imports are not developed, jobs are not generated, and society is not integrated. On the contrary, the entire economy is subordinated to satisfying foreign demand.

As a result, Argentina faces structural problems typical of an economy biased towards primary exports, with fewer and fewer industrial players capable of inserting themselves in a world with growing demands as a result of the environment in which it operates. Therefore, the macroeconomy and the commercial matrix are based on prioritizing the sale of minerals, raw materials and food.

However, the differences between them are not minor and one of the battlefields is the current price of the dollar. While international financial capital based in Manhattan (BlackRock, Vanguard, PIMCO, Franklin Templeton, Fidelity, Greylock and others) promotes and encourages the carry trade to continue earning fortunes from the difference between the growth of the official exchange rate (in February 2025, 1% per month) and the rates they obtain from inflation or interest rates (for example, LECAP and BONCAP), local companies (Techint, CGC, ARCOR, and grain collectors and marketers, etc., who also have money invested in the carry trade but as a marginal business) complain about the exchange rate lag and the lowering of tariffs that drives imports. The same goes for the countryside, grouped in the Argentine Agrarian Council (CAA), which retains grains and exports only what is necessary, putting pressure on the devaluation of our currency.

It is a question of time and financial calculations, because local groups that have gone into debt in dollar-denominated bonds such as Pampa Energía, Tecpetrol (from the Techint group), Compañía General de Combustible (Eurnekián family), Vista Oil & Gas, TGS, CAPEX, IRSA, CRESUD, EDENOR, GENNEI for 23.932 billion dollars as of January 31, 2025, according to the National Securities Commission, must measure the cost of a devaluation in their income and in the payment of the debt.

In this context, all three sectors expect the devaluation of the peso, the problem is when, by what percentage and in what way (for example, the IMF prefers the “floating band” with a floor at the current price of the dollar and a ceiling that should show how much higher it is).

Manhattan-based financial capital, without the need to finance the war as it did with Ukraine, will convert its debts into adjustable bonds and/or dollars, if its employees Caputo and Bausili create a dual bond for this purpose, all the better, to invest in the RIGI (this was proposed in the September 2024 report by Larry Fink, CEO of BlackRock) and buy part of the national heritage with the debt securities.

The other groups will try to do the same, with the advantage of playing at home and to do so they need to displace Milei, Caputo and Bausili, AmCham tributaries.

Those who always lose are the workers, retirees and pensioners, and the small and medium-sized businesses that sell to the domestic market, because in Argentina there is an inversely proportional relationship between the purchasing power of present and past work and the devaluation of the peso.

The panorama is completed with more unemployment and recession, which began in the last quarter of 2023 and was deepened by the Milei government, where 12,214 companies closed according to the Superintendency of Labor Risks (SRT) and almost 254,000 jobs were lost until October 2024 according to INDEC itself.

Horacio Rovelli * Graduate in Economics, professor of Economic Policy and Monetary Institutions and Regional Financial Integration at the Faculty of Economic Sciences (UBA).

This article has been published on PIA Global here, translation by UWI.

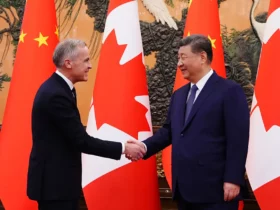

Cover photo: eltucumano.com/

References:

[1] It is a fund made up of securities and shares that belongs to national retirees and pensioners, which was created based on the nationalization of the AFJP (Private Retirement and Pension Administrators).

[2] Real services: freight, insurance, royalties, tourism, communication, etc. Financial services: interest on debt and transfer of profits from foreign companies to their parent companies.

[3] The “laundering” of more than 23 billion dollars of money clearly demonstrates this.

Leave a Reply