Context, Content, and Global Repercussions

Context, Content, and Global Repercussions

The Monroe-Donroe Doctrine has a difficult start. It’s true that, hijacking Venezuelan President Nicolas Maduro, threatening the states of Colombia and Mexico, US President Donald Trump presented a naked, violent and decided stance of US imperialism. His recent National Security Strategy claimed to “restore American preeminence” in the Western hemisphere.

In terms of economic dominance, recent results offer a mixed picture, to say the least. While the US heads to restore oil trade with Venezuela, first the EU deepened its footprint in the continent, signing – after 25 years of negotiation – its free trade agreement with MERCOSUR.

And then came what might have surprised the US President even more: Canada, a country he regularly claimed to become the US’ 51st state, has signed, amidst the conflict around Greenland, its northern neighbor, a number of agreements with the People’s Republic of China.

Context, Content, and Global Repercussions

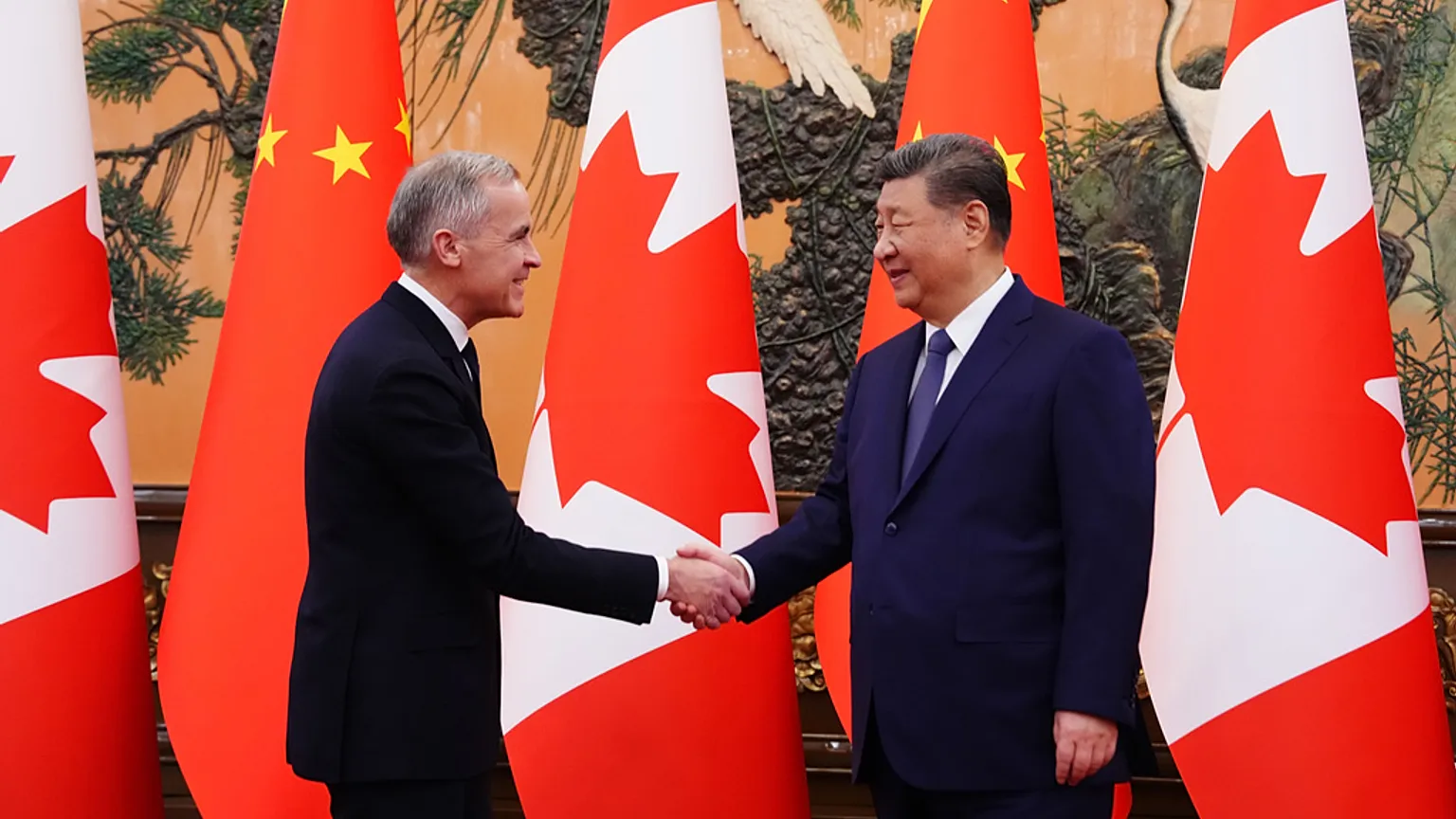

In mid-January 2026, Canada and the People’s Republic of China announced a significant bilateral agreement designed to reset and expand economic and strategic ties between the two nations. This development marked a noteworthy moment in global geopolitics, as Ottawa pursues deeper engagement with Beijing against the backdrop of intensifying global competition, shifting supply chains, and rising tensions between the United States and China. The agreements were signed during the visit of Canadian Prime Minister Mark Carney to China.

I. Background: Canada–China Relations

Historically, Canada–China relations have been complex, shaped by high-level moments of constructive engagement as well as significant diplomatic rifts. Relations notably deteriorated in 2018 following Canada’s arrest of a top Chinese technology executive, leading to the detention of two Canadians in China and a period of deep mistrust. More recently, economic tensions escalated around 2024–2025 in what has been termed the Canada–China trade war. Ottawa imposed steep tariffs on Chinese electric vehicles (EVs), and Beijing responded with heavy tariffs on Canadian agricultural exports like canola and seafood.

By early 2026, under the leadership of Prime Minister Mark Carney, Canada recalibrated its approach toward China, seeking a broader, more pragmatic trade and economic partnership—partly to diversify away from outsized reliance on the U.S. market and partly to unlock new export opportunities.

II. Main Elements of the 2026 Canada–China Agreement

The Canada–China agreement announced in January 2026 is multifaceted, spanning trade, tariffs, mobility, and broader strategic cooperation. Below are the most salient components:

1. Tariff Reductions on Electric Vehicles (EVs)

One of the central pillars of the deal is a major reduction in tariffs on electric vehicles imported from China into Canada. Under the agreement:

- Canada agreed to reduce its tariff on Chinese-made EVs to a most-favored-nation (MFN) rate of 6.1%.

- The agreement caps these imports at 49,000 EVs annually, with an anticipated increase to about 70,000 within five years.

This is a significant change from Canada’s prior policy. In October 2024, Ottawa had imposed a 100% tariff on Chinese EVs, aligning with similar protective measures undertaken by the United States in its own trade strategy. The new arrangement reverses much of that trade barrier in exchange for reciprocal concessions from China, re-opening a pathway into the Canadian auto market for Chinese manufacturers. Supporters of the tariff rollback argue it will spur competition, lower prices for Canadian consumers, and help diversify Canada’s EV supply chain. Critics—especially in Ontario’s automotive sector—warn that it could undermine domestic manufacturers’ competitiveness.

2. Agricultural and Food Export Restorations

On the Canadian export side, China agreed to significantly lower tariffs on key Canadian agricultural products that had been hit with retaliatory levies:

- Chinese tariffs on canola seed will drop from punitive levels (around 84–85%) to roughly 15% by March 1, 2026.

- Anti-discrimination tariffs on products like canola meal, lobsters, crabs, and peas will be removed or significantly reduced, at least through the end of 2026.

These measures could unlock nearly $3 billion in exports for Canadian farmers and fisheries, according to Ottawa. The reduction and removal of agricultural tariffs is a direct effort to end the tit-for-tat tariff escalation that marked the 2024–2025 trade conflict between the two countries.

3. Visa and Mobility Enhancements

The agreement includes visa-free travel arrangements for Canadians visiting China, which is expected to boost tourism, business travel, and educational exchanges between the two countries.

4. Broader Cooperation Frameworks

Beyond trade, the two countries signed multiple memoranda of understanding (MOUs) on cooperation in fields such as energy, forestry, culture, and public security, reflecting a broader strategic partnership rather than a purely transactional arrangement.

This includes a renewal of a currency swap agreement between the People’s Bank of China and the Bank of Canada, valued at 200 billion yuan (about USD 28.5 billion), aimed at enhancing financial cooperation, facilitating trade in local currencies, and promoting financial stability.

In a joint declaration, both sides also reaffirmed their commitment to multilateralism. Canadian Prime Minister stated to forge “new strategic partnership” with China.

5. Energy and Clean Tech Dialogues

Observers note that energy cooperation—both conventional and renewable—was also a topic of discussion, reflecting complementary interests. For example, there is Chinese interest in Canadian natural resources (such as oil and nuclear technology) alongside cooperation on clean energy and climate-related technologies.

III. Immediate Reactions

Canadian Government

Prime Minister Mark Carney framed the agreement as a strategic reset, positioning Canada to compete more effectively in a rapidly shifting global economy. He emphasized the need to reduce economic dependence on the United States, cultivate deeper relations with new markets, and embrace “realities” of global trade dynamic rather than relying solely on longstanding alliances.

Carney also described the deal as opening “a new strategic partnership” with China that advances mutual economic interests, broadens Canada’s market access, and supports innovation and job creation domestically.

Chinese Government

Chinese leaders welcomed Canada’s overtures and publicly described the agreement as part of a sound and stable development of bilateral ties grounded in mutual respect and complementary economic strengths. Senior Chinese officials framed the cooperation as supportive of multilateralism, economic globalization, and global stability—implicitly contrasting this with perceived protectionism elsewhere.

IV. U.S. Reaction

U.S. officials responded in a nuanced but critical way to the Canada–China agreement. The Trump administration, which maintains a strong stance on trade and China policy, criticized aspects of the deal without overtly sabotaging it.

Official U.S. Response

“Well, that’s OK, that’s what you should be doing. I mean, it’s a good thing for him to sign a trade deal. If you can get a deal with China, you should do that, right?” said Trump at the White House.

According to reporting, U.S. Trade Representative Jamieson Greer called the deal “problematic”, highlighting concerns that tariff reductions for Chinese EVs could undermine North American industrial strategies that exclude Beijing from critical sectors.

At the same time, President Donald Trump publicly stated that Canada has the right to pursue its own trade deals, avoiding a direct diplomatic confrontation while signaling discomfort with Ottawa’s pivot.

The restrained American response reflects a delicate balancing act: Washington opposes deepening economic ties between an ally and Beijing where it could erode U.S. leverage, but it has also avoided escalating rhetoric that might alienate Canada further.

Canadian–U.S. Trade Context

The broader backdrop to the Canada–China deal includes strained North American trade relations. Prior U.S. tariffs on trade with Canada, especially in metals and autos, and friction around the implementation of the United States-Mexico-Canada Agreement (USMCA) have contributed to Ottawa’s willingness to diversify trade partners. Some Canadian officials have openly linked U.S. tariffs and trade moves to their decision to seek closer ties with China.

V. The Canada–China Deal in the Context of Trump’s National Security Strategy

In December 2025, the Trump administration released its updated National Security Strategy (NSS), outlining a foreign policy and strategic framework that emphasizes geoeconomic competition, regional primacy in the Western Hemisphere, and a robust posture toward China as a strategic rival.

1. Strategic Rivalry with China

A core pillar of the Trump NSS is the characterization of China as a strategic competitor across economic, technological, military, and ideological domains. The strategy underscores the need to counter Beijing’s influence in global markets and strategic regions.

This worldview suggests that the United States would prefer its close allies (including Canada) to align with its China policy rather than pursue independent engagement. Ottawa’s tariff reductions for Chinese EVs and expanded trade with Beijing sit uneasily with this strategic lens.

2. Washington’s Economic Security Emphasis

Another element of the NSS involves economic security and supply chain resilience, especially in sectors like clean energy and technology where China is a dominant player. Tariffs and trade restrictions are tools advocated within the strategy to protect key industries and maintain strategic advantage.

Canada’s agreement to admit tens of thousands of Chinese EVs at preferential tariff rates diverges from the U.S. strategy’s aim of containing China’s industrial footprint in critical future sectors, especially clean energy–technology supply chains.

3. Regional Policy: “America First” and the Western Hemisphere

The NSS also reinforces a focus on the Western Hemisphere, with some analysts describing this as a renewed geopolitical assertion—sometimes compared to a modern “Monroe Doctrine.”

From this perspective, deeper ties between Canada and China could be interpreted as erosion of U.S. hegemony in its own geopolitical neighborhood—raising alarms in Washington about diminished influence of U.S. leadership in North America’s economic architecture.

4. Multilateralism vs. Bilateral Maneuvering

Trump’s NSS is skeptical of many multilateral institutions and frameworks, preferring bilateral arrangements that allow the U.S. to retain leverage or impose terms. Canada’s bilateral deal with China—signed outside of formal multilateral trade organizing bodies like the WTO or regional frameworks like USMCA—reflects a different strategic instinct.

Canada’s approach aligns less with Washington’s preference for coordinated Western alignment around China and more with hedging and diversification to safeguard national interests amid volatile geopolitical competition.

5. Implications for U.S.–Canada Cooperation

The Canada–China deal raises practical questions about areas of cooperation between Ottawa and Washington:

- North American supply chains: Preferential access for Chinese EVs into Canada may complicate trilateral planning on supply chain resilience.

- Tariff coordination: Differing tariff regimes between the U.S. and Canada could lead to competitive distortions or unintended trade flows.

- Strategic alignment: Divergence in China policy could require diplomatic management to maintain cohesion in other areas of security cooperation.

Some analysts suggest that Canada may be carving out a more autonomous economic strategy, influenced by perceived unpredictability in U.S. trade policy.

VI. Broader Geopolitical Impact

The Canada–China agreement has implications well beyond Ottawa and Beijing:

Global Trade Realignment

Trade relationships worldwide are under stress as competition with China intensifies. Countries are reassessing trade dependencies and alliances, attempting to balance economic opportunity with geopolitical risk. The Canada–China deal underscores the challenge of aligning economic imperatives with strategic partnership expectations among Western allies.

Supply Chain Integration and Competition

Canada’s willingness to reopen access for Chinese EVs reflects broader global competition in the clean energy sector, with China dominant in EV manufacturing and battery supply chains. Integration of China into Canadian markets could yield benefits—like lower prices and joint ventures—but also raises strategic questions about technological dependencies.

Allied Responses

Allies of Canada and the United States, especially in Europe and Asia, are watching how major economies adjust their China strategies. Some may see Ottawa’s actions as emblematic of a larger trend of recalibrating relations with Beijing to balance economic growth with security alliances.

VII. Conclusion

The January 2026 Canada–China agreement is a landmark moment in bilateral relations and global geopolitics. It represents a pragmatic effort by Canada to resolve a protracted trade war with China, unlock new economic opportunities, and diversify its trade portfolio. At the same time, it reflects broader geopolitical currents that challenge traditional Western alignment in the face of China’s rising influence.

It remains to be seen whether there will be US naval blockade against Canada too. Both EU-MERCOSUR and Canada-China agreements show that the US economy’s dominant position is in further decline on the Western Hemisphere, sustained every day more with military and illegal means.

Leave a Reply