Experts say the step will lead to better financial integration of the two countries.

Experts say the step will lead to better financial integration of the two countries.

Türkiye and China took a significant step in their economic integration. The first clearing bank in the yuan, the Chinese currency, was established in Türkiye.

In November 2025, the first Chinese yuan (RMB) clearing bank in Türkiye was officially launched: The Chinese bank, ICBC, active in Türkiye for 10 years, was authorized to directly conduct operations between the Turkish currency, Lira, and its Chinese counterpart, yuan, with effects on both trade and investment.

Recep Erçin is editor-in-chief of the Dunya daily newspaper, specialized on economy. He states: “In bilateral trade, there is a deficit of 45 billion dollars from the Turkish perspective. Turkish companies sometimes have difficulty financing imports due to foreign currency debt. This step means that bilateral trade will be conducted much more in the national currencies of both countries.”

The agreement was signed in the presence of the Chinese diplomatic corps, the president of the Turkish central bank, the director of the Turkish presidential office for investment and finance, and the deputy finance minister. Professor Adıbelli, an expert on international relations from the Dumlupınar University, describes the atmosphere at the ceremony.

“I was there and spoke with and listened to many business owners. There is an extraordinary sense of satisfaction and joy. They believe that trade will grow, and they will sell more products to China.”

The Turkish financial system will accept the Chinese currency as an international currency, just like the dollar or the euro, with greater financial integration.

“With the introduction of the yuan, Chinese companies will be able to more easily invest their operating capital in Türkiye. In a way, China is opening its vast reserves, large economy, and financial infrastructure to Türkiye. And because it is based on the yuan, this system will be protected from the threat of sanctions”, says Erçin.

The agreement adds to the renewal, in June 2025, of the bilateral swap agreement (currency exchange) between both central banks worth 4.5 billion dollars, and the strategic cooperation.

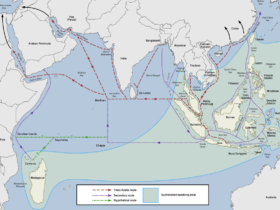

“The Chinese side spoke about the integration of the Turkish economy into China’s. Cooperation within the Belt and Road Initiative is being elevated to a new level. In fact, Turkish-Chinese political cooperation was already progressing, with the economic sector lagging behind. Now we see that cooperation between economic institutions is also deepening.”

As part of the agreement, the Chinese UnionPay Credit Card was introduced in Türkiye – another step of protection against possible Western sanctions. This introduction might even help third parties, such as Russian tourists travelling to Türkiye, to avoid payment problems.

Both experts emphasize that this agreement creates alternatives to the dominance of the dollar and constitutes a step towards financial multipolarity.

Leave a Reply