The era of single-market dependence is over

The era of single-market dependence is over

By Dure Akram, Lahore / Pakistan

Pakistan’s economy is feeling the pinch of U.S. protectionism after President Trump’s sweeping tariffs imposed a blanket 10 percent tariff on all U.S. imports, coupled with a punitive 29 percent surcharge on Pakistani goods—despite a modest $3 billion surplus with America—prompting Islamabad to scramble for relief.

The immediate fallout will be severe: Pakistani textile shipments to the U.S. might plunge by 10–15 percent in Q1 2025 alone, undercutting the country’s largest employer and main export earner.

Damage control kicked in within days, and Pakistan’s commerce and foreign ministries activated crisis cells. Federal Commerce Minister Jam Kamal Khan assembled exporters across 12 key sectors and pledged, “We will try to bring high tariff lines down through negotiations because the U.S. is a big market for Pakistan. We are optimistic.” He added that “our trade officers and ambassadors in the U.S. are in continuous contact with the relevant authorities to ensure Pakistan’s concerns are effectively communicated.“

Parallel talks in Washington saw Foreign Minister Ishaq Dar engage U.S. Secretary of State Marco Rubio on “making progress toward a fair and balanced trade relationship,” including potential cooperation on critical minerals.

Meanwhile, a prime-ministerial working group is currently reviewing every impacted tariff line, exploring options from tariff rationalization to strategic U.S. commodity imports–ranging from cotton and soybeans to crude oil—to rebalance trade flows and stave off further levies.

Forging “Inways” with Central Asia

Realizing that reliance on Western markets might soon become a liability, Islamabad had already intensified outreach to its overland neighbors. According to the Pakistan Bureau of Statistics, exports to Turkmenistan, Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan grew by 21.17 percent to $158.07 million in 2024 before logistical bottlenecks triggered a 17 percent contraction to $90.8 million in H1 2024-25.

In Tashkent earlier this year, Uzbek President Shavkat Mirziyoyev had lauded Pakistan as “our trusted partner…whose international reputation is steadily growing” and vowed to push bilateral trade from $400 million toward $2 billion “in the short term.” Mirziyoyev and PM Shehbaz Sharif reaffirmed their commitment to the $4.8 billion Uzbekistan–Afghanistan–Pakistan (UAP) Railway, which promises to slash transit times by up to five days and integrate Pakistan into Central Asia’s catchment area.

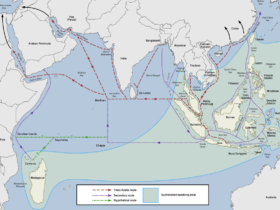

Beyond bulk commodities, Pakistan aims to export textile inputs and processed agriculture products northward, while importing critical minerals and machinery; creating mutually reinforcing value chains that circumvent traditional sea-based routes vulnerable to geopolitical spikes.

Belarus: A Northern Economic Outpost

In mid-April, PM Shehbaz Sharif concluded a two-day visit to Minsk where he and President Alexander Lukashenko signed 15 memoranda of understanding covering agro-industry, defense procurement, digital finance, and workforce mobility. The Foreign Office highlighted that “the Prime Minister’s visit underscores the strong and ongoing partnership between Pakistan and Belarus.” Belarusian ministers also described enhanced trade as “pivotal for strengthening the economy and promoting bilateral relations.”

Negotiations included plans to admit up to 150,000 Pakistani workers to address Belarus’s labor shortages; opening a fresh remittance corridor that could inject $500 million annually into Pakistan’s foreign exchange pool.

Joint ventures in fertilizer production, food processing, and machinery manufacturing are under discussion, leveraging Belarus’s advanced Soviet-era industrial base and Pakistan’s lower wage structure.

Türkiye: Friends to Partners

Pakistan’s decades-old camaraderie with Türkiye appears to have translated into concrete economics, thanks to a push by both Islamabad and Ankara. Under a Preferential Trade Agreement activated in May 2023, Islamabad and Ankara aim to raise bilateral trade from $1.4 billion in 2024 to $5 billion by 2025. In Ankara this week, PM Sharif reaffirmed, “Pakistan and Türkiye share a unique and historic bond, deeply etched in the hearts of our people” and announced the fast-tracking of a Turkish special economic zone in Pakistan alongside plans to operationalize the Islamabad–Tehran–Istanbul corridor for uninterrupted land access to European markets.

Discussions also covered joint programs in defense production, digital infrastructure, and pharmaceuticals–sectors where Turkish industrial capacity and Pakistani market potential complement each other.

The Ground Reality

Of course, it is much easier to sit in the air-conditioned commentary box and point to the light at the end of the tunnel. Voices from the industries offer a mixed verdict. Fawad Anwar, Chairman of the Pakistan Textile Council, for instance, exclaimed, “There is an opportunity to grab (business) from China. How well we can do that depends on how well we can sit at the table and negotiate.” He underscored that a $2 billion upside in textile orders could materialize if logistical hurdles and tariff barriers are swiftly addressed.

“Tariffs have created problems around the world, and while Pakistan is also affected, the impact here is not as severe,” added Aqeel Karim Dhedhi, Chairman of the AKD Group, a large business conglomerate. “Pakistan’s exports are still low, while imports are high, so the effect of tariffs is smaller,” he noted, adding that global stock markets plunged 14–20 percent, whereas Pakistan’s benchmark index fell by only 5 percent.

Tariff politics are not running the horror show alone. Abdul Rahim Nasir, Chairman of All Pakistan Textile Mills Association (APTMA), warned that rising regional gas prices (now at $9 per MMBtu versus $5–7 per MMBtu) among peers could undercut competitiveness in energy-intensive sectors. “Without regionally competitive energy tariffs, our export sectors face existential risk,” he cautioned.

Policy Prescriptions for Multipolar Growth

Fast-Track Regional Corridors: Accelerate the UAP Railway and operationalize the Islamabad–Tehran–Istanbul corridor, securing funding and cross-border security guarantees.

Currency-Swap Lines: Negotiate swap arrangements with Türkiye, Belarus, and Central Asian central banks to minimize dollar dependency and ease settlement friction.

South-South Investment Fund: Establish a joint $1 billion Pakistan–Belarus–Türkiye–Central Asia infrastructure fund, targeting agro-processing, textiles, and light manufacturing.

Digital Trade Platforms: Partner with Türkiye’s tech ecosystem to build interoperable e-commerce gateways for Pakistani SMEs, leveraging Türkiye’s logistics networks and free-trade zones.

WTO Reform Advocacy: Champion a tariff-credit mechanism within the WTO to offset asymmetric burdens on developing economies and prevent collateral damage from great-power disputes.

The era of single-market dependence is over

Pakistan’s confrontation with Trump-era tariffs has exposed the fragility of overreliance on Western consumers. By weaving new “inways,” through Central Asia’s railways, Belarusian industrial pacts, and Turkish economic corridors, Islamabad can construct a resilient, multipolar trade matrix. Success hinges on translating diplomatic breakthroughs into tangible trade volumes, synchronizing policy across ministries, and empowering industry stakeholders. While challenges such as logistical hurdles and financing constraints in these emerging partnerships remain, a coherent strategy and sustained South-South solidarity, Pakistan can transform collateral damage into a launchpad for sustainable, inclusive growth in an increasingly fragmented global economy.

Leave a Reply